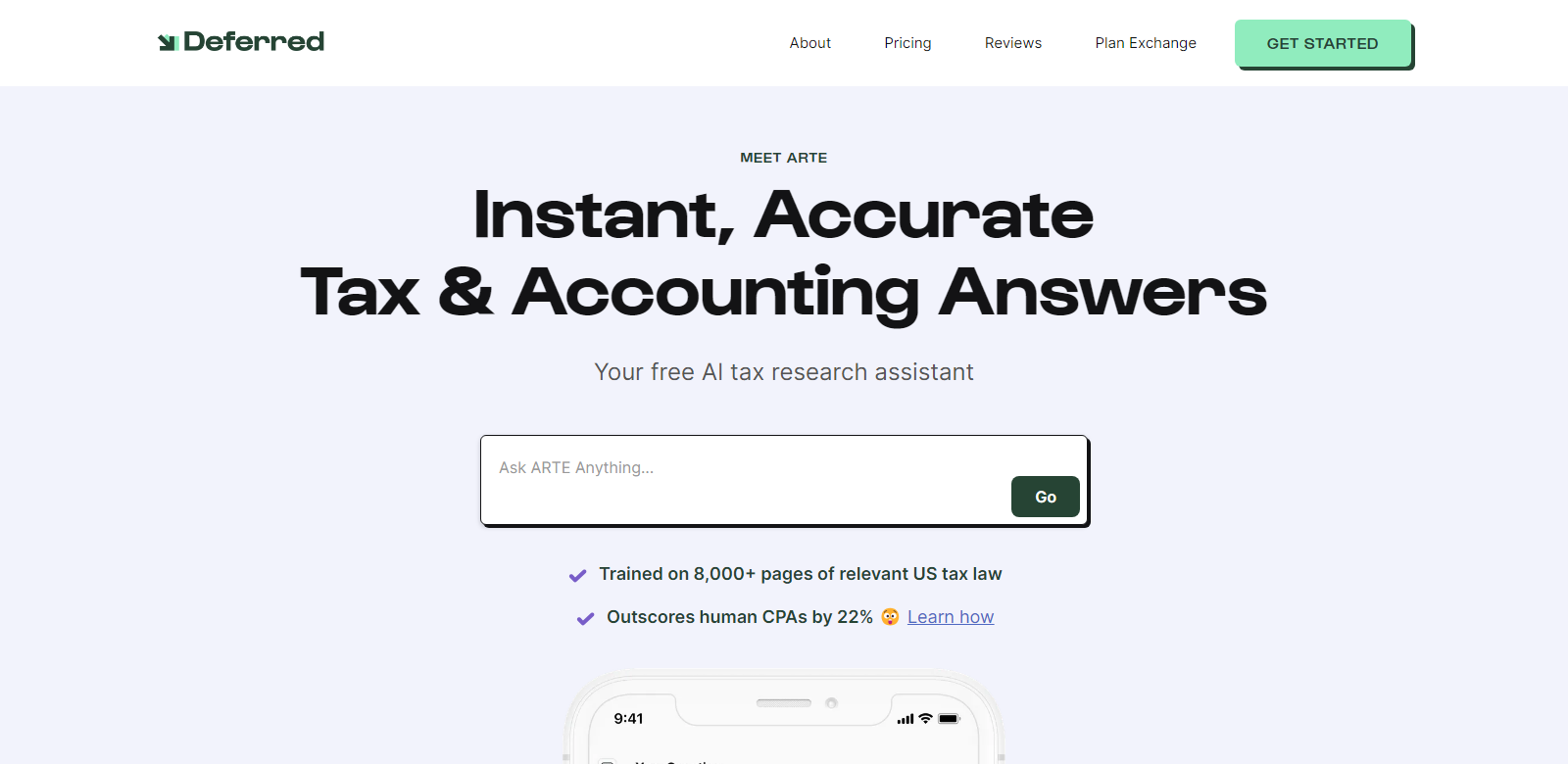

ARTE - Your AI-Powered Real Estate Tax Assistant

ARTE, the AI Real Estate Tax Expert, is a revolutionary chatbot designed to assist users with real estate tax queries and research. This innovative tool leverages artificial intelligence to provide accurate, timely, and personalized assistance, making it an invaluable resource for real estate professionals and homeowners alike. With its user-friendly interface and comprehensive knowledge base, ARTE is set to transform the way individuals approach real estate tax issues.

Customers of ARTE

Understanding the diverse clientele that ARTE serves is crucial for appreciating its impact on the real estate and tax sectors. The platform caters to a variety of user personas, each with unique needs and expectations. Here are some key customer segments:

-

Real Estate Agents:

Real estate agents often face complex tax scenarios involving property sales, capital gains, and deductions. ARTE provides them with up-to-date information and guidance, enabling them to advise clients effectively and ensure compliance with tax regulations. -

Homeowners:

Homeowners seeking to understand their property tax obligations can benefit from ARTE's insights. The chatbot simplifies the complexities of tax assessments, exemptions, and deductions, helping homeowners make informed decisions regarding their properties. -

Investors:

Real estate investors require detailed tax strategies to optimize their portfolios. ARTE assists them in navigating tax implications related to rental income, property depreciation, and investment gains, ensuring they maximize their returns while remaining compliant. -

Tax Professionals:

Tax professionals can enhance their service offerings with ARTE. By utilizing the chatbot's extensive database, they can quickly retrieve information and provide accurate advice to clients, streamlining their workflow and improving client satisfaction. -

Property Managers:

Property managers deal with various properties and their associated tax obligations. ARTE aids them in understanding the tax implications of different property types, helping them manage their portfolios effectively and minimize tax liabilities.

Problems and Solutions by ARTE

In the realm of real estate taxes, numerous challenges arise that can complicate the decision-making process for various stakeholders. ARTE addresses these issues head-on.

Problems ARTE Found

-

Complex Tax Regulations:

Real estate tax laws are often intricate and vary by location, making it difficult for users to stay informed about their obligations. ARTE simplifies this complexity by providing easy access to relevant regulations and guidelines. -

Lack of Timely Information:

Tax laws frequently change, and staying updated can be challenging. ARTE ensures users receive the latest information, helping them make timely decisions. -

Difficulty in Understanding Deductions and Exemptions:

Many users struggle to comprehend what deductions and exemptions they qualify for. ARTE clarifies these concepts, offering personalized advice based on individual circumstances. -

Time Constraints:

Real estate professionals often lack the time to conduct thorough tax research. ARTE streamlines this process, providing quick answers and resources at their fingertips. -

Inaccessibility of Expert Advice:

Accessing tax experts can be costly and time-consuming. ARTE democratizes access to expert-level advice, making it available to all users regardless of their budget.

Solution by ARTE

ARTE addresses these challenges through its advanced AI algorithms and extensive database. The chatbot is designed to deliver accurate answers to a wide range of real estate tax questions, from basic inquiries to complex scenarios. By utilizing natural language processing, ARTE understands user queries and provides contextually relevant information. Furthermore, it continuously updates its knowledge base to reflect the latest tax laws and regulations, ensuring users always have access to the most current information.

In addition to answering questions, ARTE can guide users through various tax scenarios, helping them understand potential deductions and exemptions applicable to their situations. This personalized approach not only saves time but also empowers users to make informed decisions regarding their real estate investments and tax obligations.

Use Case

ARTE can be employed in numerous scenarios to enhance real estate tax management:

-

Tax Planning for Home Buyers:

Homebuyers can utilize ARTE to understand the tax implications of their purchases, including potential deductions and exemptions available for first-time buyers. -

Investment Property Management:

Investors can ask ARTE about the tax consequences of selling a property, including capital gains tax calculations and potential strategies to minimize tax liabilities. -

Tax Compliance for Property Managers:

Property managers can consult ARTE to ensure they are compliant with local tax regulations, helping them avoid costly penalties. -

Real Estate Agent Support:

Real estate agents can use ARTE to quickly answer client questions about property taxes, enhancing their service and building trust with clients. -

Tax Filing Assistance:

Individuals preparing their tax returns can leverage ARTE to clarify what information is needed and what deductions they may qualify for, simplifying the filing process.

Top Features of ARTE

ARTE boasts a range of features designed to enhance user experience and provide comprehensive tax assistance:

-

Instant Answers:

Users can receive immediate responses to their tax-related questions, reducing the time spent searching for information. -

Personalized Guidance:

ARTE tailors its advice based on individual user profiles, ensuring relevant and useful information is provided. -

Comprehensive Knowledge Base:

The chatbot is equipped with a vast database of real estate tax information, covering various scenarios and regulations. -

User-Friendly Interface:

ARTE is designed to be intuitive, making it accessible for users with varying levels of tech proficiency. -

Regular Updates:

The platform is continuously updated to reflect changes in tax laws, ensuring users have access to the latest information.

Frequently Asked Questions with ARTE

-

How does ARTE keep its information up to date?

ARTE utilizes a dynamic knowledge base that is regularly updated with the latest tax regulations and guidelines. This ensures that users receive accurate and timely information tailored to their specific needs. -

Can ARTE assist with both federal and state tax issues?

Yes, ARTE is designed to provide insights into both federal and state tax regulations, helping users navigate the complexities of real estate taxes across different jurisdictions. -

Is ARTE suitable for beginners in real estate?

Absolutely! ARTE is user-friendly and provides explanations in simple terms, making it an excellent resource for beginners looking to understand real estate tax obligations. -

How can ARTE help real estate investors?

ARTE assists investors by providing information on tax implications related to rental income, property sales, and potential deductions, helping them optimize their investment strategies. -

What types of queries can ARTE handle?

ARTE can address a wide range of queries, from basic questions about property taxes to more complex scenarios involving multiple properties and tax strategies.