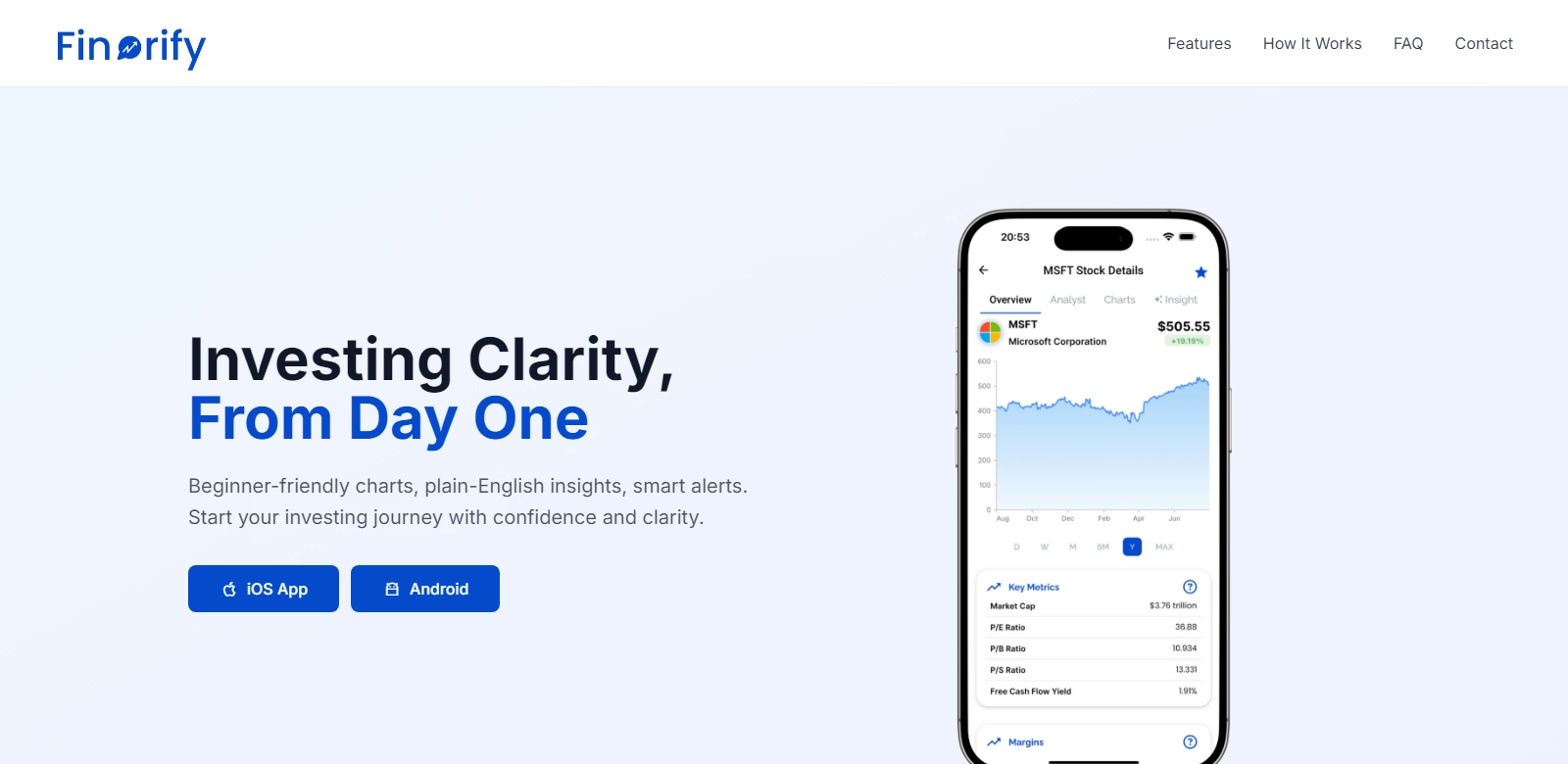

Finorify - Your Gateway to Effective Stock Analysis

Finorify is revolutionizing the world of stock analysis for beginner investors by providing an intuitive platform that makes understanding financial data simple and accessible. In a world where investment decisions can cause anxiety, Finorify offers a streamlined approach to stock evaluation, setting itself apart with its user-friendly design and comprehensive tools tailored for novices. By bridging the gap between complex financial information and potential investors, Finorify is not just a tool; it is a guide for those looking to navigate the financial markets with confidence. This platform caters not only to novices but also to seasoned investors who appreciate the convenience and simplicity it offers, making stock analysis a less daunting task. For more insights, check out how Finorify can enhance your investment journey.

Customers of Finorify

Understanding the diverse customer base that Finorify serves is essential in appreciating its value proposition. The platform addresses the specific needs of various segments, ensuring a tailored experience for each user. Here are the primary customer personas that benefit from Finorify's offerings:

-

Beginner Investors: Many individuals new to investing face uncertainty when interpreting financial data. Finorify provides these users with educational resources and simplified metrics to aid their decision-making process. With easily digestible information, they can confidently begin their investment journey.

-

Part-Time Investors: Individuals who invest on a part-time basis may lack the time and resources to conduct in-depth research. Finorify equips them with a set of tools that allow for efficient stock analysis without overwhelming them with complex data. The platform's output is concise, making it easy for part-time investors to quickly assess potential investment opportunities.

-

Retired Investors: Many retirees look to make their retirement savings work for them. Finorify offers features that help retired individuals understand market trends and make informed investment decisions, allowing them to enjoy their retirement without financial stress.

-

Students and Young Professionals: Young individuals interested in finance as a career or as a potential side hustle can use Finorify to build their knowledge base. The platform provides explainers and tutorials that enable them to understand stock analysis fundamentals while preparing them for future endeavors in finance.

-

Financial Educators: Professionals in financial education can leverage Finorify as a teaching tool, presenting their students or mentees with a hands-on approach to stock analysis. The platform serves as a practical supplement to classroom learning, making financial concepts more relatable and engaging.

Problems and Solution by Finorify

Despite the increasing interest in investing, many hurdles prevent new investors from entering the market. Finorify identifies these challenges and addresses them effectively.

Problems Finorify Found

-

Complexity of Financial Data: Many beginner investors struggle to interpret complex financial reports, leading to paralysis by analysis.

-

Time Constraints: New and part-time investors often find it hard to dedicate the required time to research individual stocks comprehensively.

-

Lack of Educational Resources: There's a significant gap in accessible educational resources that meet the needs of novice investors seeking to educate themselves about stock analysis.

-

Emotional Decision-Making: Beginner investors frequently make impulsive decisions based on fear and excitement rather than cold hard data.

-

Inadequate Support: Many investors feel overwhelmed without mentorship or guidance in their investment journey.

Solution by Finorify

Finorify tackles these issues head-on through its dedicated platform that emphasizes user experience and educational value. The solution lies in several key areas:

-

User-Friendly Interface: The design ensures ease of navigation, enabling users to access the information they need effortlessly. The platform distills complex financial data into visual formats and simple language for easy understanding.

-

Analytical Tools: Finorify provides tailored research tools, including stock screeners that filter options based on the user's criteria, saving time for investors who might feel overwhelmed.

-

Educational Content: The website features a library of articles, guides, and tutorials to help new investors understand stock analysis principles fundamentally.

-

Emphasis on Data-Driven Decisions: With resources that promote analysis over emotion, Finorify encourages users to make informed choices rather than rash decisions based on market hype.

-

Community Support: Finorify fosters a supportive community where users can ask questions and share insights, thus reducing the feeling of isolation often faced by beginner investors.

Use Case

The versatility of Finorify is evident in its various use cases that cater to different investor needs. For example, a beginner investor can use the platform's tutorials to grasp the basics of stock market operations. A part-time investor can utilize the stock screener to identify suitable investments quickly. Moreover, a financial educator might use Finorify as a teaching aid to give students a practical experience of market analysis. Each of these use cases showcases the practicality and adaptability of Finorify in different contexts.

Top Features of Finorify

Finorify stands out due to its robust set of features designed with the user in mind. Here are some key offerings that enhance the user experience:

-

Intuitive Dashboard: A central hub displaying key market data, news updates, and user portfolio performance at a glance.

-

Stock Screener: A powerful tool that allows users to filter stocks based on various criteria, making it easy to identify potential investments.

-

Educational Resources: An extensive library filled with articles, videos, and tutorials aimed at demystifying stock analysis.

-

Community Forums: A space where users can interact, ask questions, and share experiences, fostering a sense of belonging and learning.

-

Real-Time Market Data: Access to up-to-date market information helps investors make informed decisions based on current conditions.

Frequently Asked Questions with Finorify

-

What makes Finorify different from other investment platforms?

Finorify sets itself apart through its focus on beginner investors. The platform provides a user-friendly interface, educational resources, and analytical tools tailored to new investors, ensuring they can navigate the complexities of stock analysis with ease. -

Is Finorify suitable for experienced investors?

While Finorify primarily targets beginners, its tools and resources can also benefit experienced investors looking for streamlined analysis and quick insights without excessive data overload. -

Can Finorify help me make a profit?

While Finorify provides the resources and tools to aid in stock analysis and decision-making, it cannot guarantee profits as investing inherently involves risks. Users are encouraged to conduct their due diligence when making investment decisions. -

How do I get started with Finorify?

Getting started with Finorify is simple. Prospective users can visit the website, create an account, and explore the various tools and resources designed to assist in their investment journey. -

Does Finorify offer personalized investment advice?

Finorify provides educational resources and analytical tools for users to make informed decisions but does not offer personalized investment advice or financial planning services, as it aims to empower users to take control of their investment strategies.