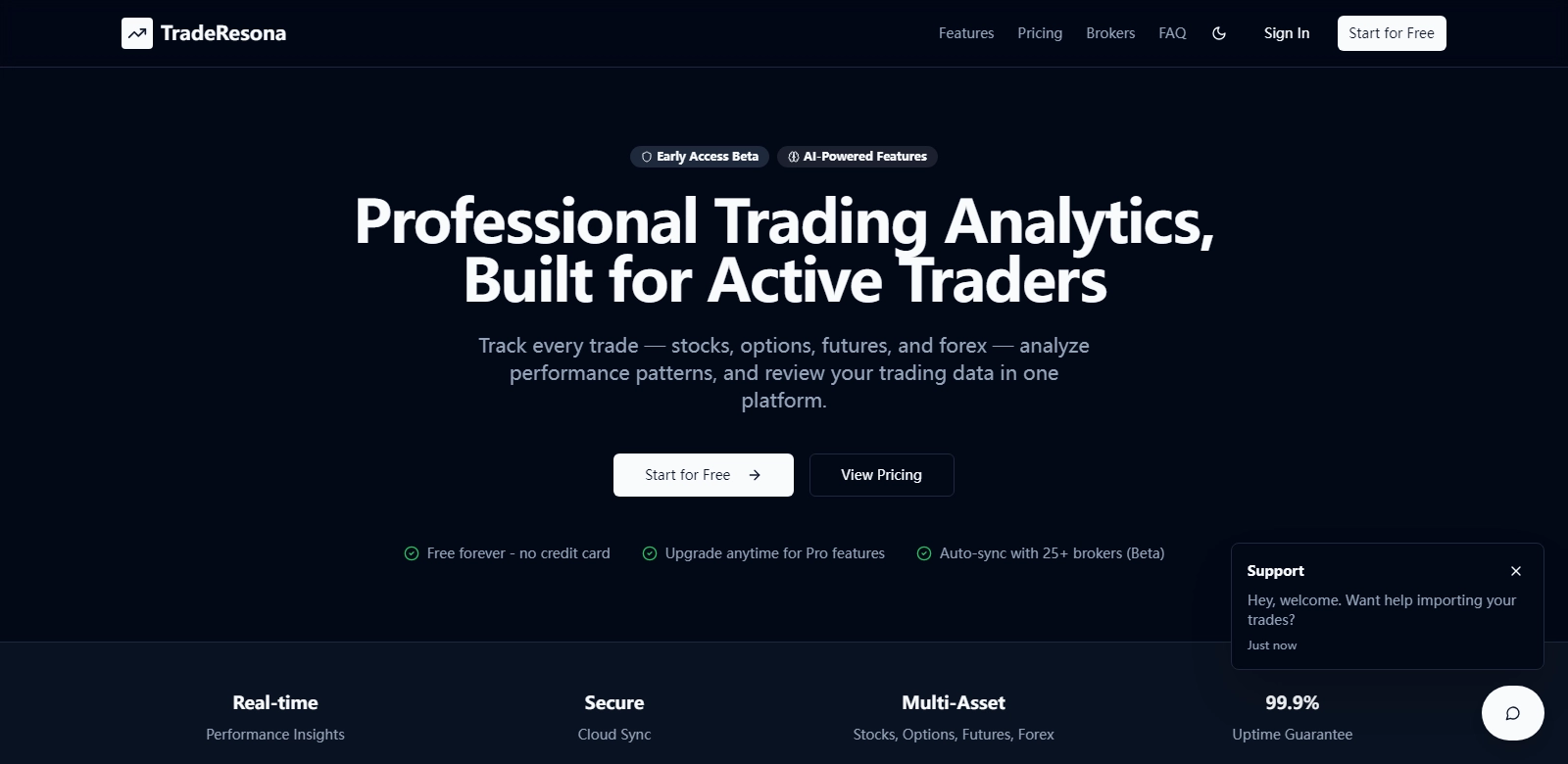

TradeResona: AI Powered Trading Journal and Performance Analytics

TradeResona is revolutionizing the trading landscape by integrating artificial intelligence and advanced performance analytics into a comprehensive trading journal. This platform not only helps traders track their performance and risk but also delves into the psychological aspects of trading. The blend of technology and analytics provided by TradeResona equips active traders with the tools needed to refine their strategies and achieve their financial goals. As active trading becomes increasingly competitive, resources like TradeResona are becoming indispensable for both novice and seasoned traders alike.

Customers of TradeResona

Understanding the various customer personas that utilize TradeResona allows for a better appreciation of its many functionalities. Each user group experiences unique benefits tailored to their needs.

-

Professional Traders:

Professional traders typically engage in high-frequency trading, where speed and accuracy are crucial. For this group, the ability to analyze their trading history and performance metrics within a single platform is invaluable. TradeResona’s sophisticated analytics help them identify patterns in market behavior and adjust their strategies in real-time. -

Retail Investors:

Retail investors benefit greatly from the simplified performance metrics provided by TradeResona. This software ensures that they track their investments wisely and make informed decisions based on robust analytics rather than mere speculation. By fostering a deeper understanding of risk and performance, they can flourish in an otherwise intimidating market. -

Financial Analysts:

Analysts often require precise data for their evaluations. TradeResona provides comprehensive performance analytics which enable analysts to conduct nuanced assessments of traders’ activities. The insights gleaned assist in providing better investment advice to clients. -

Trading Educators:

Individuals involved in trading education can use TradeResona as a case study tool, providing students with real-world trading data. The platform is excellent for showing students how trade metrics evolve over time, elucidating the complexities of trading psychology, and enhancing their educational experience. -

Hobbyist Traders:

For those who trade as a hobby, understanding the emotional and psychological dynamics of trading is crucial. TradeResona’s focus on trading psychology helps these traders identify emotional triggers that can affect their decision-making processes. This knowledge aids in developing a more disciplined approach to trading.

Problems and Solution by TradeResona

The trading sector is rife with challenges that traders face daily. TradeResona addresses multiple pain points faced by its users, turning potential setbacks into stepping stones toward success.

Problems TradeResona Found

-

Lack of Performance Insights:

Many traders struggle to analyze their past trades effectively. Without quantitative insights, identifying successful strategies or areas needing improvement becomes nearly impossible. -

Emotional Trading:

The psychological aspects of trading can lead to irrational decisions. Traders often succumb to emotional triggers that influence their buying and selling practices, leading to losses. -

Risk Management:

Effective risk management strategies are often underutilized, especially by less experienced traders. Many do not analyze how much capital to expose in each trade or how to mitigate potential losses adequately. -

Data Overload:

In a data-rich environment, traders can feel overwhelmed by the sheer volume of information. This often leads to analysis paralysis, where they struggle to make critical decisions due to an excess of available data. -

Lack of Comprehensive Tools:

Many existing solutions do not combine performance tracking with psychological analysis, leaving a gap in the trader’s toolkit.

Solution by TradeResona

TradeResona offers a robust solution to these problems through its integrated platform. The powerful analytics engine provides actionable insights derived from past trades, helping traders pinpoint their successes and missteps. This allows users to adapt strategies accordingly. By incorporating an analysis of trading psychology, it addresses the emotional component that often leads to impulsive decisions. The system also emphasizes the importance of risk management, suggesting optimal positioning sizes and stop-loss strategies to protect capital effectively. Furthermore, TradeResona streamlines data into a user-friendly interface, reducing overload while enhancing clarity relevant to decision-making. This makes it easier for traders to focus on practical strategies rather than feeling bogged down by excessive information.

Use Case

The application of TradeResona can be showcased through various use cases. For instance, a professional trader might utilize the platform to backtest their latest strategy against historical data, ensuring it performs well under different market conditions. A financial analyst could leverage TradeResona to compile impactful reports for clients highlighting key performance metrics. Meanwhile, a retail trader may rely on the site’s analytics to determine their weekly performance trends, helping them pivot their approach when losses occur. Trading educators frequently incorporate it into their curriculum, providing students with practical tools and examples from real trades. Lastly, a hobbyist trader could reflect on emotional experiences documented in their trading journal to understand how these influenced their trading decisions.

Top Features of TradeResona

The following are some of the leading features that set TradeResona apart in the trading journal landscape:

-

Comprehensive Performance Analytics:

TradeResona provides detailed analytics on trading performance, capturing vital metrics and trends. -

Psychological Tracking:

Users can monitor emotional responses to trades, fostering greater awareness of psychological factors impacting trades. -

Intuitive Interface:

The dashboard is designed for ease of navigation, making it accessible for users of all experience levels. -

Automated Reporting:

Traders can generate reports effortlessly, summarizing performance over customizable time periods. -

Integration Capabilities:

TradeResona can integrate with popular trading platforms, allowing for seamless data import and synchronization.

Frequently Asked Questions with TradeResona

-

How does TradeResona help improve my trading performance?

By providing sophisticated analytics and tools for performance tracking and psychological insights, TradeResona enables traders to understand their strengths and weaknesses better. This knowledge allows for more informed decision-making, ultimately leading to improved trading outcomes. -

Can I use TradeResona for different types of trading?

Yes, TradeResona is versatile and can be utilized for various trading styles, including day trading, swing trading, and long-term investing. The platform adapts to the specific needs of each trading strategy, making it beneficial across different trading environments. -

What kind of data does TradeResona require?

Users can input various data types, such as trade entries and exits, market conditions, and emotional notes. The more comprehensive the data provided, the more insightful the analytics delivered. -

Is my trading data safe with TradeResona?

Absolutely. TradeResona prioritizes data security, employing encryption and other security measures to ensure user data remains confidential and secure from unauthorized access. -

Can beginners use TradeResona effectively?

Definitely. The platform's intuitive design and educational resources make it accessible even for novice traders, offering guidance and insights that help them learn and grow steadily.