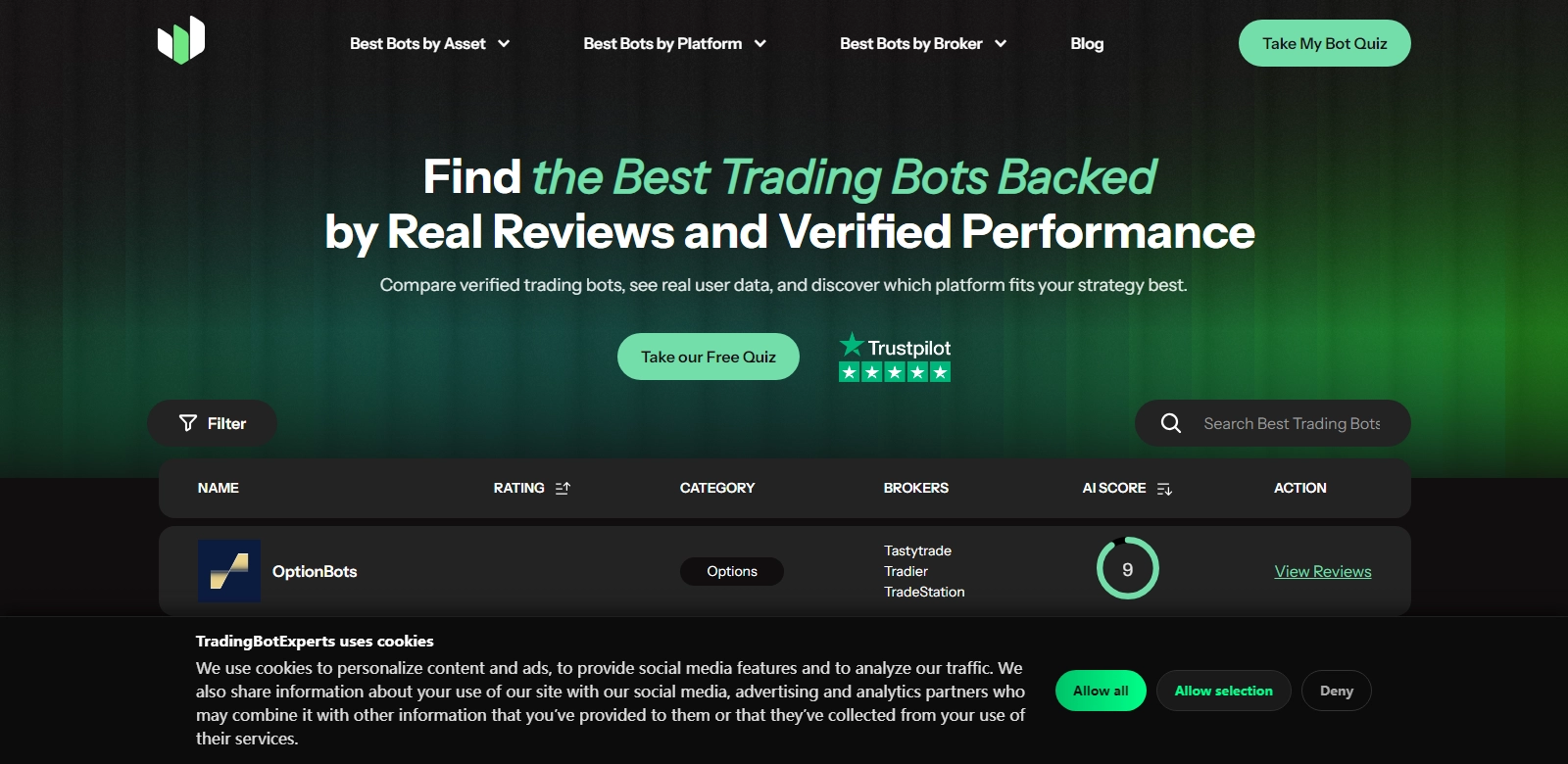

Comprehensive Analysis of AI Trading Bots

AI trading bots have revolutionized the landscape of trading by presenting a suite of automated solutions designed for various markets, including cryptocurrency, stocks, and forex. These highly sophisticated tools leverage algorithms and machine learning to optimize trading strategies significantly, providing traders with a competitive edge. Through services like Trading Bot Experts, users can discover and compare the best AI-powered trading bots tailored to their needs. As technology continuously evolves, understanding the current offerings can ensure traders make informed decisions about which tools to incorporate into their trading practices.

Customers of AI Trading Bots

Understanding the diverse customer base utilizing AI trading bots is crucial in tailoring these solutions. The following are key customer personas that benefit from these tools:

-

Retail Traders:

Retail traders often seek to capitalize on market trends without spending extensive hours analyzing charts and data. AI trading bots empower them with automation, enabling them to execute trades based on established criteria. The ease of use paired with robust performance metrics aligns perfectly with their need for efficiency. -

Institutional Investors:

Larger entities, such as hedge funds and investment firms, leverage AI trading bots to manage significant amounts of capital. These bots provide sophisticated analytical insights, allowing institutions to make data-driven decisions that optimize their portfolios. They utilize bots not only for trading but also for risk management and strategy testing. -

Crypto Enthusiasts:

With the rise of digital currencies, crypto enthusiasts employ AI trading bots due to their ability to process huge datasets quickly. Bots can identify optimal trading opportunities for various cryptocurrencies, aiding users in navigating the volatile market. This affords them the potential for higher returns based on real-time analysis. -

Forex Traders:

Many forex traders apply AI solutions to take advantage of small price fluctuations across different currency pairs. The AI trading bots help optimize their trading strategies by executing high-frequency trades that would be impossible to manage manually, aligning perfectly with their need for speed and precision. -

Long-term Investors:

Even long-term investors utilize trading bots for strategic rebalancing and portfolio management. The data-driven approach that bots provide ensures that investment decisions are based on performance metrics rather than emotional reactions to market changes.

Problems and Solution by AI Trading Bots

The complexities of trading in today’s markets can lead to considerable challenges for various users. AI trading bots aim to address these issues efficiently.

Problems AI Trading Bots Found

-

Emotional Trading:

One of the most significant challenges traders face is emotional decision-making, which can adversely affect trading performance. Traders often struggle to stick to their strategies during high volatility. -

Market Analysis Overload:

The abundance of market data can overwhelm traders. Analyzing this information to form actionable strategies demands both time and expertise. -

Inability to Trade 24/7:

The global nature of trading necessitates constant monitoring. Many traders cannot continuously engage with their accounts due to other commitments. -

Risk Management:

Effective risk management is critical for successful trading. Traders often fall short in their ability to quantify and manage risk effectively. -

Skill Gaps:

New traders may lack the expertise required to create effective trading strategies or even to understand market dynamics.

Solution by AI Trading Bots

AI trading bots address these problems by automating the trading process with precision. They ensure that trades are executed at optimal times according to pre-set parameters, eliminating emotional biases. The bots conduct comprehensive analyses of market data, leveraging machine learning algorithms to identify emerging trends and opportunities. Moreover, with the ability to trade 24/7, these bots can execute strategies at any time, ensuring that users do not miss profitable opportunities due to time constraints.

Proficient risk management strategies embedded within many AI trading bots assist traders in protecting their capital. By analyzing factors such as volatility and market sentiment, bots suggest trade sizes and stop-loss orders that correspond with users’ risk tolerance levels. Finally, they also cater to the skill gaps among traders, providing educational insights and performance analysis that help users refine their strategies over time.

Use Case

There are numerous use cases showcasing the effectiveness of AI trading bots across different trading landscapes. For instance:

- A retail trader employs a bot to automate monthly investments in ETFs, optimizing their investment strategy while ensuring discipline.

- An institutional investor relies on bots for executing trades in high-frequency arbitrage opportunities, minimizing human error and reaction time.

- A crypto enthusiast uses an AI bot to carry out scalping strategies, taking advantage of minute price discrepancies across various exchanges.

Top Features of AI Trading Bots

The robust capabilities of AI trading bots place them at the forefront of trading technology. Here are some critical features:

-

Advanced Analytics:

AI trading bots process vast quantities of market data, providing insights into potential trends and weaknesses in trading strategies. This enhances decision-making and overall performance. -

Automated Execution:

Bots execute trades instantly based on predefined strategies, ensuring no profitable opportunity is missed while removing the emotional stress of decision-making. -

Risk Management Tools:

User-defined risk management tools help traders set parameters for losses and profits, fostering safer trading environments. -

24/7 Trading:

The inability to monitor the market constantly is mitigated, as AI trading bots operate round the clock, executing strategies without downtime. -

Customizable Strategies:

Traders can customize and backtest their strategies before live deployment, thereby refining approaches and improving anticipated returns over time.

Frequently Asked Questions with AI Trading Bots

-

What are AI trading bots?

AI trading bots are automated software programs that utilize algorithmic trading strategies to execute trades in financial markets. They leverage machine learning and artificial intelligence algorithms to analyze market conditions and make trading decisions. -

How do I choose the right AI trading bot?

Selecting the right bot involves evaluating several factors, including the bot’s performance history, user reviews, customization options, and the fees associated with its use. Additionally, ensure that it supports the market segments you wish to trade in. -

Can beginners use AI trading bots?

Yes, AI trading bots can be particularly beneficial for beginners. Many bots offer user-friendly interfaces and built-in educational resources to support new traders in understanding the market dynamics while leveraging automated trading strategies. -

Are AI trading bots effective?

While results can vary, many traders report positive outcomes using AI trading bots. These bots use real-time data analytics, allowing them to capitalize on market inefficiencies that human traders might miss. -

What is the cost of using AI trading bots?

Costs vary significantly based on the provider and the features offered. Some bots charge a monthly subscription or transaction fees, while others may require an upfront purchase. Researching and comparing different offerings can uncover cost-effective options.